Facing repossession is stressful. And it naturally raises many questions about practicalities.

For example, can you sell your house before it gets repossessed?

And, if not – who sells the house after it has been repossessed?

Read on to find out.

What causes a house to be repossessed?

The most common reason a house is repossessed is because you fail to meet your mortgage repayments.

This itself might be caused by several factors – from loss of employment, divorce, and much else in between.

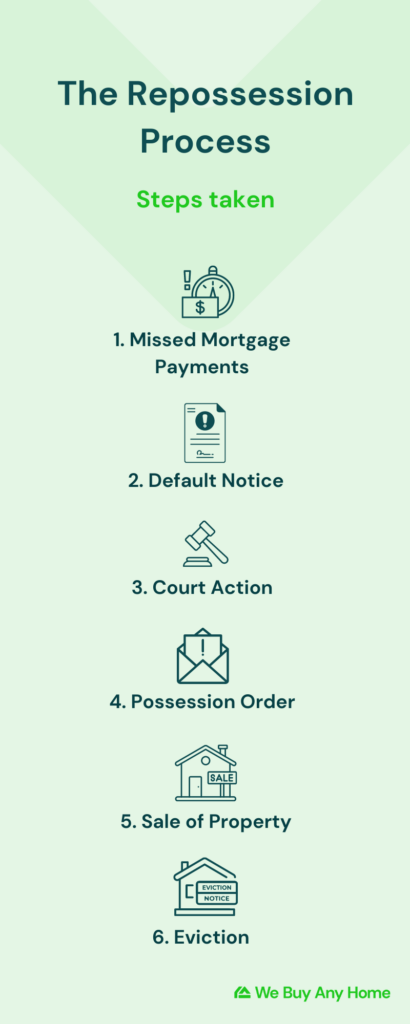

The repossession process

The repossession process involves several steps. Many of these steps allow the borrower to reverse proceedings.

Usually, the lender will give you a few months to get back on track and may even be willing to negotiate new repayment terms.

The mortgage law gives lenders the legal right to apply to repossess your home after you’ve been in arrears for 90-180 days.

However, they will apply to a court to repossess your property if you are uncommunicative or cannot meet your repayments.

Borrowers also have the right to contest repossession orders in court.

Court hearing

At the hearing, a representative for the lender will explain why they want to repossess the property.

You will then have a chance to defend yourself, explaining why you have fallen into arrears and how exactly you will pay it back.

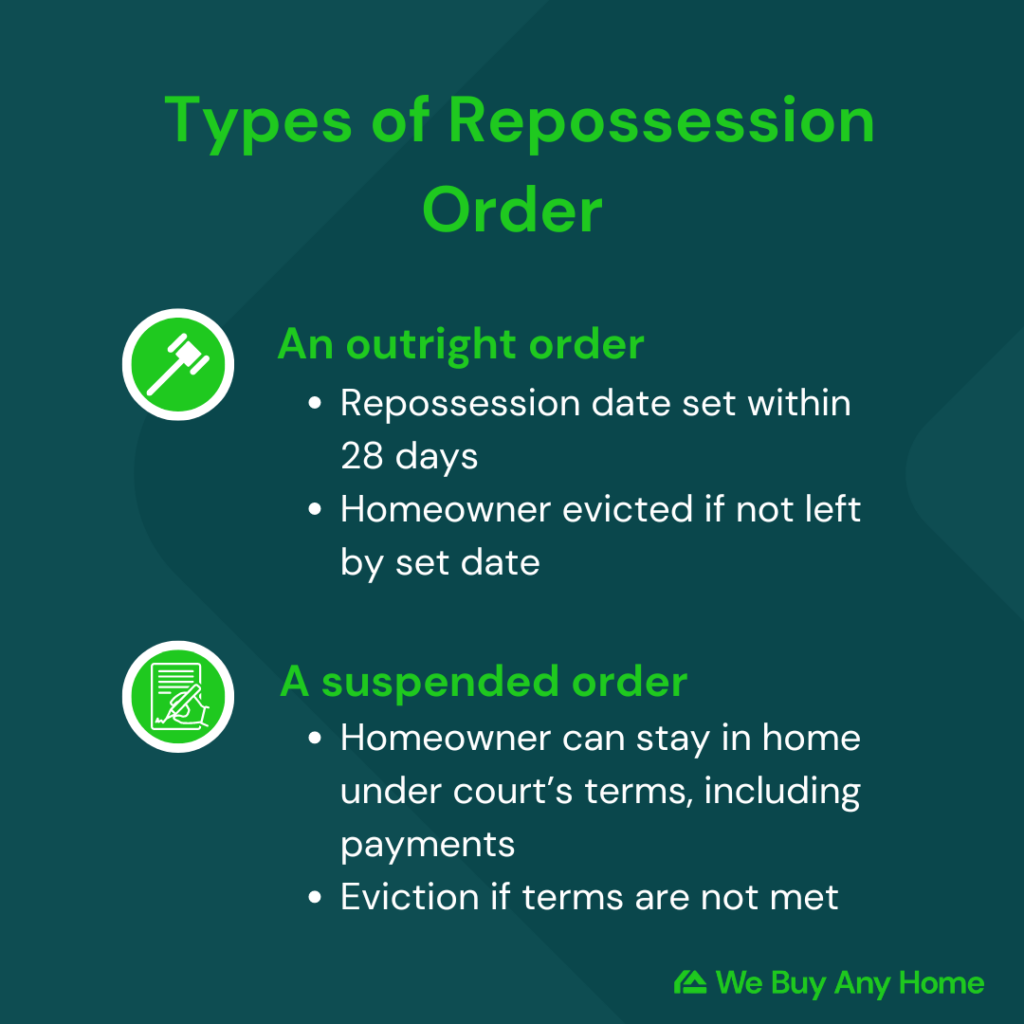

What are the two types of repossession order?

If a court orders your house to be repossessed, it can happen in two ways:

- An outright order

- A suspended order

With the former, a clear date for repossession will be set, typically within four weeks.

If you receive a suspended order, you can stay in your home under the terms set by the court.

This may include paying a set amount on top of your regular monthly mortgage payment.

However, if you break these terms, you will again be vulnerable to repossession.

Can I sell my house before repossession takes place?

Yes, you can sell your house to avoid repossession.

If you suspect that you will fall into mortgage arrears soon, then it may be worth selling your house proactively to avoid this.

Alternatively, if you have already fallen into arrears, there is still time to sell your house to pay it back.

Sometimes, selling your property can take at least several months, which may be too long if you face repossession within the next few weeks.

Therefore, many people in this position sell directly to a cash-buying company, which can complete the purchase within seven days.

Who sells a repossessed house?

Once a house has been repossessed, it is under the bank’s ownership, and they choose to sell it. This will usually be done through an estate agent or an auction house.

A lender will usually try to sell the repossessed house as quickly as possible to limit their expenses.

Even in this scenario, they may not recover all their losses because these properties usually sell for less than their original market value.

What price will a repossessed house be sold for?

When a house is sold at auction, it will be for below its original market value.

Bidders can make an offer on it – and how high this figure goes can vary for each auction. The seller (the bank) will determine the starting price.

What condition will a repossessed house be in when I buy it?

Sometimes, a repossessed house will be in excellent condition if the previous owner has taken care of it. In other instances, it may be run down and require some renovation.

Lots of auction bidders do a property survey before the selling day to determine its true condition.

Remember that the previous owner may have removed some appliances, such as wardrobes, washing machines, or fridges.

You may also find that the property has been disconnected from the utility providers.

On some occasions, the previous owner will still be living (squatting) there, and part of the repossession will involve hiring bailiffs to remove them forcibly from the property.

What happens if a repossessed house sale price does not cover the debt?

If the sale price of a repossessed property does not cover the amount owed on it, the lender must absorb these losses themselves.

This is why the organisation usually tries to sell the house quickly to minimise losses.

They will also aim to negotiate with anyone who falls into mortgage arrears for as long as possible. Sometimes, homeowners can even secure a 12-month mortgage grace period.

After all, it does not work in the lender’s favour to repossess the house.

Can I delay repossession so I can sell the house?

Yes, repossession can be delayed so you can sell the house.

At the repossession hearing, you are allowed to make your case. You can show the court that the sale of the house would cover all debt that is due.

If so, the court can make a suspended possession order that gives you time to sell.

If this happens, you can continue to live in your home while you sell. The judge decides how long to delay repossession—it could be up to a year.

Do all estate agents sell repossessed homes?

No, not all estate agents get involved with selling properties that have been repossessed.

This is because there can be complications – such as broken appliances or squatters – that they don’t want to get involved with.

Some estate agents sell repossessed properties and advertise their specialisation in this area.

It would help if you spoke to any specific estate agent in your area to determine whether they do.

Remember that even when using an estate agent, repossessed homes usually sell for below their ‘typical’ market value.

Are benefits affected by the sale of a repossessed house?

The sale of the house may affect your benefits.

Typically, your benefits will not be affected if – after your mortgage and other debts are paid off – you are left with less than £6,000 or are in negative equity.

However, you cannot get universal credit if you have more than £16,000 left from the sale.

How often are houses repossessed?

Figures suggest that repossessions have become more common in recent years.

For example, in a recent three-month period, 733 homes were taken into possession (averaging 244 per month) across England.

This data is supported by other online figures, which show that in a recent calendar year, between 70 and 280 homes in England were repossessed monthly.

Meanwhile, in Wales, this figure varied between 5 and 25.

If you proactively inform your lender about repayment difficulties and proposed solution, they will likely be far more lenient/favourable with you.

Will property repossession affect my credit score?

Yes, if you fall into mortgage arrears and eventually get your house repossessed, it will negatively impact your credit score.

A repossession will appear on your credit report for six years, starting from your first missed payment date.

Some specialist mortgage lenders will offer you a mortgage even after a repossession.

However, remember that this usually has less favourable financial terms, as the lender wants to minimise its risk.

Sell your house fast with We Buy Any Home

We Buy Any Home are chain-free cash house buyers who can purchase your property up-front and quickly, without hassle or stress.

If you are looking to avoid repossession, we offer the perfect opportunity to sell your house quickly.

Fill in our enquiry form below if you want a cash offer for your house.