Each year, thousands of homes in the UK get repossessed.

This can be a very stressful process and one that can easily spiral out of control.

However, this does not have to be the case.

The process is open to reasonable negotiation. And you should know your rights.

And a number of preventative measures can be taken to halt the repossession of your home.

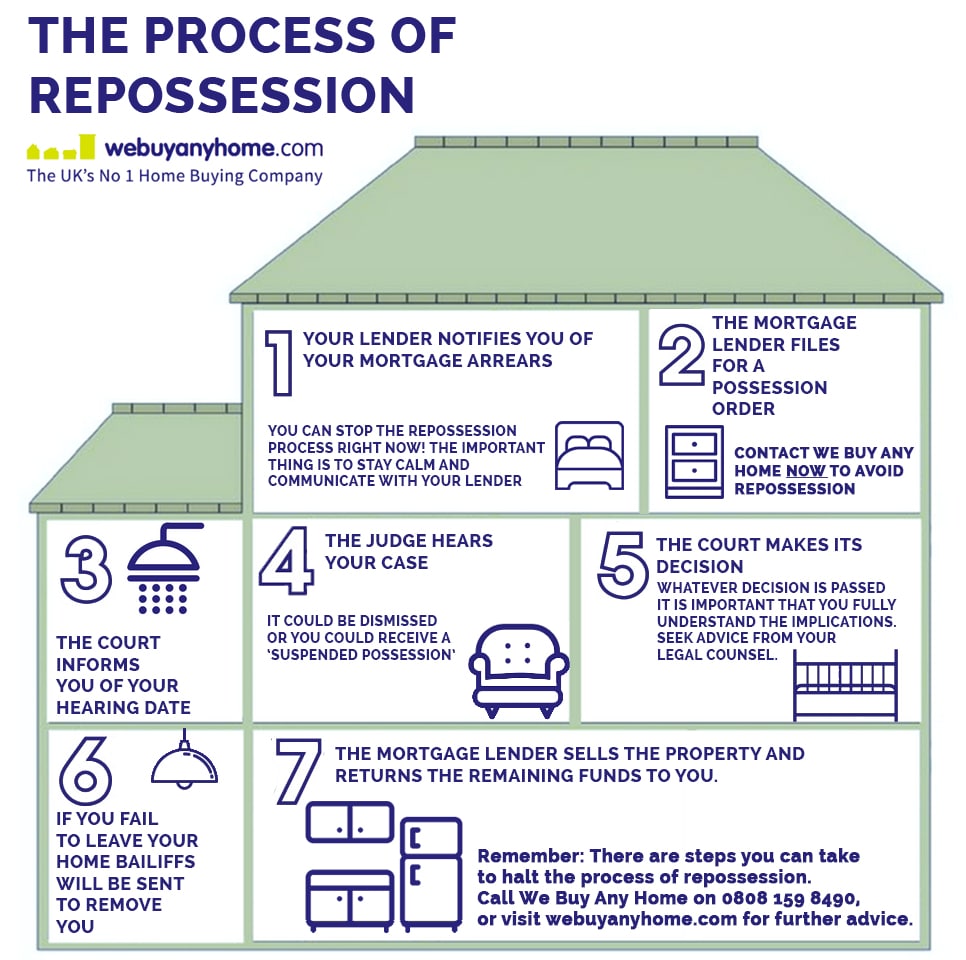

How the home repossession process works

1. You receive notification from your lender about your mortgage arrears

They should contact you to request you find a solution; this gives you a chance to put together a proposal for your lender. This could include any of the following:

- Changing to an interest-only mortgage to reduce the monthly cost

- Adding your arrears to the mortgage itself

- Taking a ‘mortgage holiday’ (if your mortgage is flexible)

- Selling an endowment policy.

At this stage, you could also consider acting to raise the required funds to pay your lender. And you should consider speaking to a debt management organisation. You could:

- Take in a lodger

- Rent out your home

- Put your home on the market yourself

The lender then accepts or declines your solution; if they decline then they will warn of court action to begin repossession.

2. The mortgage lender proceeds with filing a suit in court asking for a possession order

3. The court will write to you to inform you of the hearing date

- At this stage, you must complete and return the included defence form

- You should also seek legal advice in preparation for the hearing, in most cases, a free ‘lay representative’ would provide a possible solution.

4. The case is taken to court and the judge hears the repossession case

The outcomes from this include:

- Your home being repossessed and the lender selling the property to pay your dates

- A suspended possession order is made meaning you can stay in your home under certain repayment conditions

- The judge may also choose to postpone or dismiss the case.

5. If the court has made an order for repossession:

- You generally have between 28-56 days to leave your home.

- Usually, lenders will add their legal costs to your outstanding payments.

6. If you fail to leave your home in time, Bailiffs will be sent to remove you

- If your appeal fails, the process of eviction begins.

- Bailiffs need a warrant to remove you and will provide a set eviction date. They cannot use violence, nor the threat of violence, but are able to call the police should you resist eviction.

- The cost of the Bailiffs is commonly added to the outstanding debt.

7. The mortgage lender sells your home

- Until this sale is complete you must continue to pay the interest on what you owe. Any leftover funds from the sale will be transferred to you.

- If there is any shortfall then this will have to be paid separately, through agreed and negotiated terms with your mortgage lender.

- Any residing debt after the sale may also be transferred to whomever the property was sold; you will then own this party. Likewise, insurance may cover the shortfall payment to the mortgage lenders; you will then owe this to the insurance company.

REMEMBER: The mortgage lender must keep all communications with you clear and easy to understand.

If at any point you become confused it is important that you seek clarification and take every opportunity to understand their argument and requests so that you can best form your defence position.