Buying a house on your own is difficult.

Today, an increasing number of people team up to buy property under a shared ownership model.

Read on to find out more about buying property on your own.

What do people think about buying property on their own?

With salaries not keeping up with house prices, it is not surprising that many think they will rent for their entire life.

It’s widely believed that only those inherit property (or money) or secure a high-paid job can afford to buy on their own.

How much is needed to buy a property alone?

A study by The National Housing Federation revealed that, on average, first-time buyers in London would need to save £2,300 a month to own a property by 2021.

With an average monthly salary in the city floating around the £2,833 mark, this means savers would be left with just £533 to fund their rent, bills, groceries and leisure activities.

Here’s how the rest of England tallies up:

| Area | Average Monthly Income | Savings Per Month to buy in 2021 | Monthly Spend Left |

| South East | £2,509 | £1,410 | £1,099 |

| South West | £2,077 | £1,000 | £1,077 |

| East of England | £2,333 | £1,200 | £1,133 |

| West Midlands | £2,083 | £823 | £1,260 |

| East Midlands | £2,166 | £787 | £1,379 |

| Yorkshire & Humber | £2,023 | £725 | £1,298 |

| North West | £2,083 | £723 | £1,360 |

| North East | £2,034 | £638 | £1,396 |

We Buy Any Home’s research on buying a home

Research by We Buy Any Home analysed the opinions of 2,094 UK citizens in relation to buying a home.

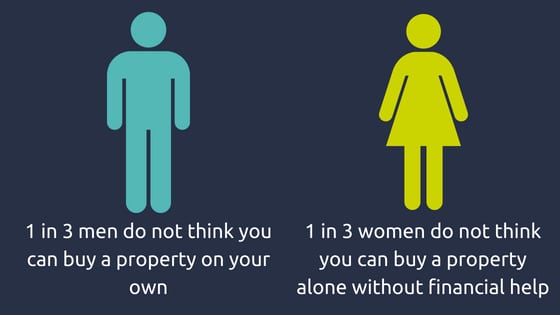

Data revealed that 1 in 6 people do not believe it is possible to buy a property alone and 30% of respondents think that you cannot buy a property without financial help from sources such as family or friends.

The results for men and women were extremely close, with 1 in 3 men convinced buying a property alone is impossible, and 1 in 4 women agreeing.

However, the majority of women (30%) believe it is possible to buy a property if you have help with a deposit.

33% of all those surveyed aged 35 and over do believe you can buy a property on your own.

This is in stark contrast to the 18 to 34 bracket, where 1 in 3 don’t think you can buy a property alone and a further 1 in 4 believe you cannot buy a property without financial help.

Across the UK

When broken down by country, Scotland and Northern Ireland were the more optimistic. Percentages of people that think they can buy alone here were:

- 33% in Scotland

- 50% in Northern Ireland.

63% of Welsh respondents do not believe it is possible to buy a property on your own or without financial help. This is a sentiment shared by 2 in 3 English people.

How to make buying a property on your own a feasible goal

Whilst our research highlights that many people in the UK don’t believe buying a property on their own is an achievable goal, there are things to think about that could potentially make the process easier:

Improve your credit score

A good credit score is crucial when applying for a mortgage. It shows lenders that you’re a reliable borrower. To improve your credit score:

- Pay bills on time

- Avoid maxing out credit cards

- Consider consolidating debt.

Organise your paperwork

Gather essential documents like proof of funds, proof of income, bank statements, and identification. Having these readily available streamlines mortgage applications.

Put down a 15% deposit (minimum)

A larger deposit can reduce your monthly mortgage payments. It can also potentially secure better interest rates.

Aim to save at least 15% of the property’s value as a down payment.

Focus on affordable properties

Take into account your income, monthly expenses, and potential interest rate increases when calculating your target property’s price range.

Choosing the right type of property might make a difference here, too. For example, perhaps you were looking at semi-detached, but a terraced house would be better.