Finding out how much your home is worth is not straightforward.

There are many other steps.

Guide, asking prices and selling prices are often very different.

Only the really proves how much your property is worth.

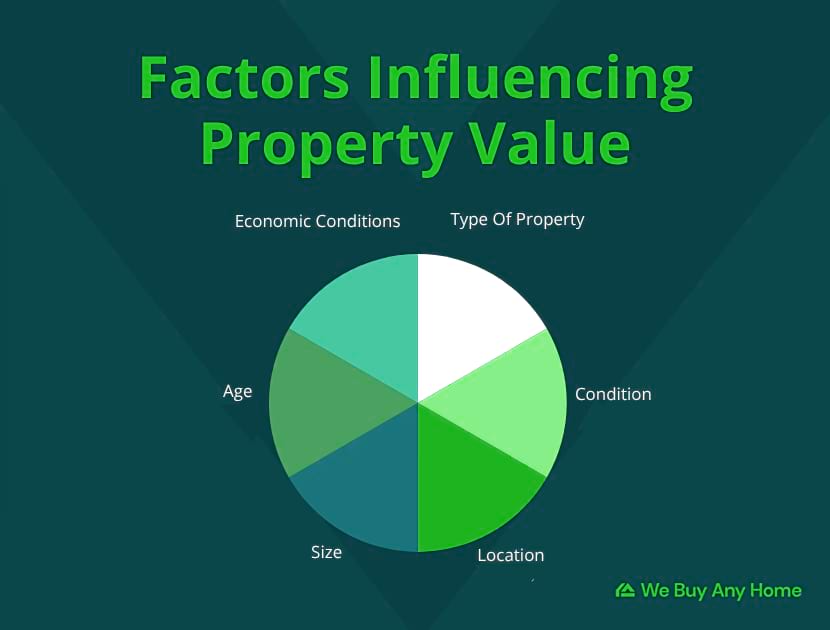

Overview of factors for influencing property value

The main factors that influence how much a property is worth are:

- Type of property

- Condition

- Location

- Size

- When your property was built

- Economic conditions (local and national).

These factors all interact to form a property’s value.

For example, properties in cities are often worth more than those in the countryside. But the latter kind are often larger – and larger properties sell for more than smaller ones.

But all things being equal, older, larger, detached houses in good condition in cities under good market conditions are worth the most.

Getting a valuation

A valuation is the first step in working out how much your property is worth.

Note: A valuation is not definitive. A lot can change between this and a completed sale.

There are different kinds of valuation. Each varies in accuracy and cost.

1. Use an estate agent

Estate agents’ valuations are usually free because they want to win business.

However, some estate agents don’t give accurate valuations. They exaggerate property value to win business.

After all, even if a property sells for much less, estate agent fees still include a commission from the final sale price (usually around 1.5%, although it may be slightly higher or lower).

To value property, most estate agents will visit property in-person and compare it to similar local properties.

2. Use an online estate agent or property buyer

Online estate agents often use desktop research to value properties (often referred to as a desktop valuation).

This includes using the Land Registry and comparisons to recently sold similar properties nearby to cross-check valuations.

3. Use a conveyancer

Conveyancers are experienced independent property valuers.

They will inspect your property in-person before giving you their professional opinion, which is less biased and more accurate than most estate agents.

However, using a conveyancer comes at a cost, usually of over £1,000.

Finding out how much your property is really worth

Marketing a property

Even after getting a valuation, knowing how much a property is worth is difficult until you put it on the open market.

The level of interest you get from marketing a property helps you gauge how realistic your asking price is.

If you get low or no interest, you may need to lower your asking price.

Viewings

Getting a high number of viewings are a good sign that you have correctly estimated your property’s value.

But this is only if you get a good level of offers. After all, if your property is not worth what you think it is, many viewings might simply be a waste of time.

Offers

The volume of offers you receive, and the amount they are for, will give you a clearer yet view of how much your property is worth.

If most viewers put an offer in significantly under the asking price, for example, it’s a sign your home is valued too high.

Surveys

Property surveys are commissioned by buyers interested in making offers. Their goal is to physically inspect properties to confirm whether or not there are unknown issues.

If there are, potentials buyers will likely reduce their offer.

Conveyancing & searches

The conveyancing process involves transferring the legal ownership of a property. It includes legal searches on the property.

If these uncover issues, such as property easements, short leases, etc., buyers will likely reduce or withdraw their offer.

Ways to increase the value of a house

There are several steps you can take to increase your property’s value, including:

- Add an extension or outbuilding

- Improve exterior’s appearance

- Fix issues.

Probate and tenanted houses

The following two conditions could significantly reduce your property’s value:

- Tenants living in-situ

- It’s in an unliveable condition.

These types of properties are considered less desirable for potential buyers. This is primarily because they may be unable to live there themselves.

If you are struggling to sell your house, and want to sell your house fast in any condition, We Buy Any Home can help. Contact us today.