The UK government once estimated that approximately 30 – 40% of houses in the UK were bought with cash.

So, whether you are buying a house for cash or selling to a cash buyer, it’s useful to understand the cash buying process.

Read on to learn more.

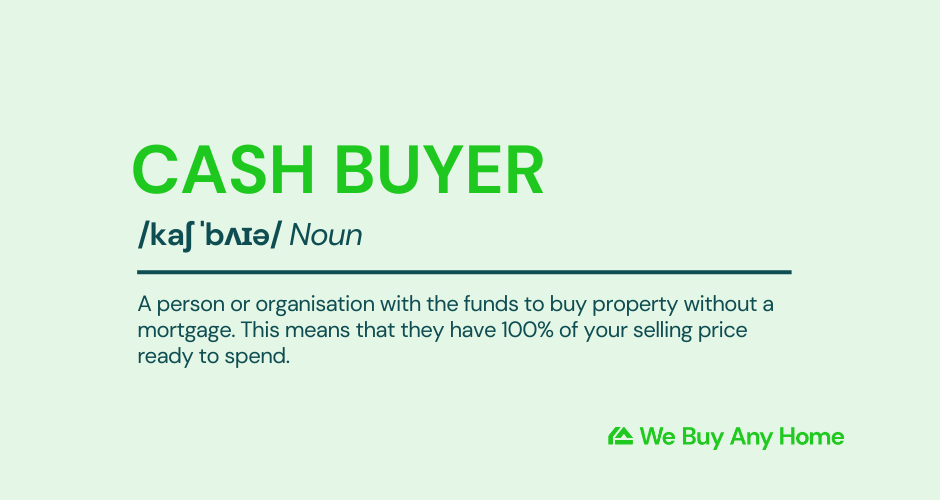

What is a cash buyer?

In property, a cash buyer is a person or organisation who purchases a property with cash.

It does not mean buying with physical cash. It means buying a property upfront and outright.

In other words, this means not depending on a mortgage or any other loan to complete a property deal.

There are different types of cash buyers.

Some are simply individuals with enough wealth to purchase property without a mortgage. Others are professional companies or investors looking to profit from property quickly.

What does ‘cash buyers only’ mean?

‘Cash buyers only’ means that the seller is only interested in cash offers for a property.

Sellers who add this phrase to their marketing might be able to speed up a property sale.

However, it will reduce their marketing reach. Many see it as a sign that the property has defects or is generally difficult to sell.

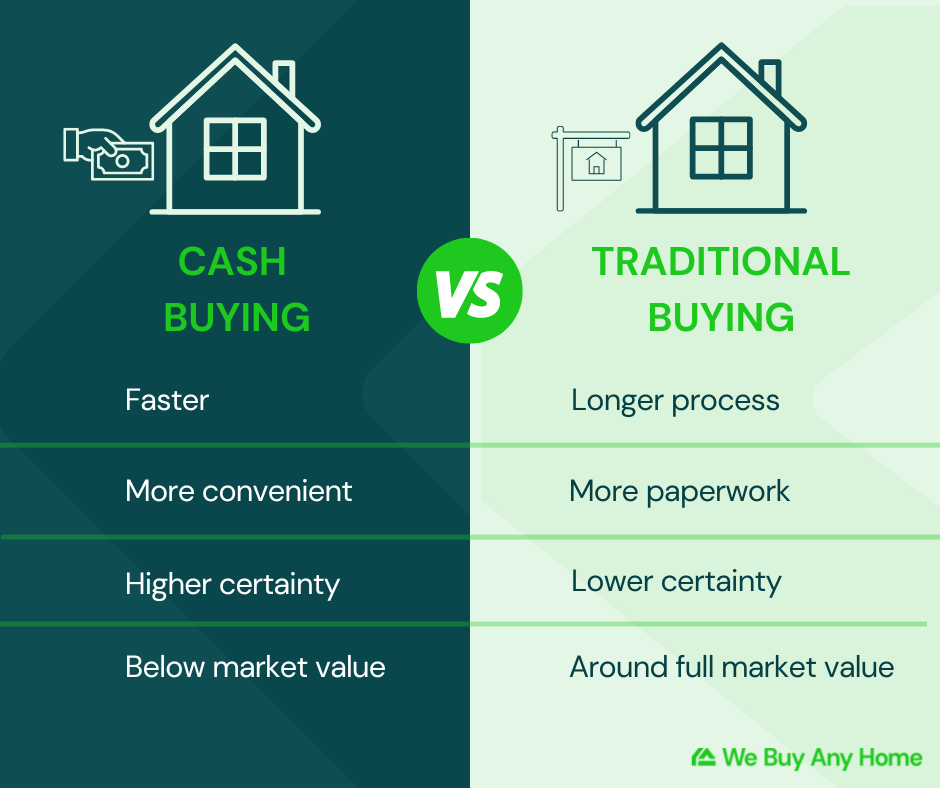

Cash buying from the buyer’s perspective

Cash buyers can avoid mortgage interest payments and buy houses that lenders will not offer on (ones with short leases, in terrible condition, high flood risk, etc.).

Generally, it’s a cheaper, faster and more flexible way to buy a property.

Cash buying from the seller’s perspective

Selling to a cash buyer provides more certainty of a sale’s timeframe and faster completion.

However, sellers often receive below-market value from cash buyers – typically 75 – 85% of a property’s value.

Cash buyers vs. estate agents

Cash buyers don’t often use an estate agent (i.e., a traditional buyer) to buy a house.

They usually work directly with the seller. This avoids any estate agent’s commission being deducted from the sale price.

Sellers to cash buyers also gain advantages over working with an estate agent. For example, cash buyers often cover their legal fees.

Do cash buyers charge a commission?

Unless an estate agent is involved, there should not be any commission on a cash sale of a property.

For sellers, this means that even if cash offers are slightly below market value, they may receive the same amount in the long run.

The cash house buying process

1. Agreeing an offer

The first critical step of any cash-buying process is agreeing on an offer.

This offer is typically between 75% and 85% of a property’s value on the open market. It is not usually worth the buyer’s time to pay more than this.

Some sellers find this difficult to accept. After all, it equates to thousands or tens of thousands of pounds.

So, negotiation is a vital part of this stage.

2. Providing proof of funds

Some sellers will ask buyers to provide proof of funds (POF) early on. POF can reassure sellers that the cash buyer is legitimate.

Some non-cash buyers claim to be cash buyers and then stall sales until they find funds.

This benefits them but is highly detrimental to the seller, who – in this scenario – would have been better off selling on the open market.

3. Finding a solicitor

Having legal representation when entering a house transaction is always a good idea.

This applies to both buyers and sellers.

Some cash buyers will cover the seller’s legal fees. Solo property developers don’t often don’t make this offer.

4. Complete searches

Important property searches include:

- The Local Authority Search

- Checking for planning restrictions and highway issues

- The Water and Drainage Search

- The Environmental Search.

Additionally, a Land Registry search confirms property boundaries and ownership.

Typically costing around £300, these searches are crucial for identifying potential issues.

There are optional searches (mining, chancel, bankruptcy, etc.)

5. Complete survey(/s)

A house survey is a detailed property inspection conducted by a qualified expert.

There are several different kinds of surveys. They variously examine properties’ condition, including:

- Structure

- Boundaries

- Potential defects (e.g., subsidence, dampness).

And more.

This information is crucial for buyers to make informed decisions and negotiate the purchase price.

6. Organise paperwork

Cash buyers are still property transactions like any other. Sellers need to have the correct documentation in place.

Depending on the circumstances, they may still require:

- An Energy Performance Certificate (EPC)

- Title deeds

- Property Information Form

- An official exchange of contracts.

And more.

7. Completion

Completion is where legal ownership transfers from the seller to the buyer.

It’s the final stage of any property transaction, occurring a few weeks after the exchange of contracts.

On this day, the buyer’s solicitor transfers the purchase funds to the seller’s solicitor.

Once the money is received, the buyer is given the property keys.

This typically occurs between 10 a.m. and 2 p.m. on the agreed completion date.

How long does cash buying take?

Cash buying offers a much quicker route to completing a house sale than traditional buyers.

While some cash sales can be completed within a week, the average cash buying timeframe is a few weeks.

Surveys and searches (when used) can add time. As can negotiations.

Once a sale is completed, the funds should be transferred between accounts within 24 hours (excluding any bank delays that may occur over a weekend).

Advantages of cash buying process

The cash-buying process provides significant advantages to both buyers and sellers.

One main advantage is the speed, efficiency, and certainty involved. Unlike traditional property sales, there is no need for:

- Mortgage approvals

- Marketing

- Fall-throughs

- No onward chains or chain breaks to deal with.

And more.

Do cash buyers have cancellation or withdrawal fees?

Cash buyers vary in whether or not they charge cancellation or withdrawal fees.

Those that charge might base the amount on the stage a seller is at in the process. Others might have a fixed fee.

Sellers should check the terms and conditions of each seller before agreeing to work with them.

Do I need a solicitor when buying a house in cash?

Yes. A solicitor is still valuable to the buying process. This is still true when a mortgage isn’t involved.

There are plenty of other roles that this expert can fulfil. This includes:

- Exchange of contracts

- Carrying out property searches

- Transferring funds

- Liaising with other parties

- Property registration.

Unless you have legal expertise, you shouldn’t try these things yourself.

A qualified solicitor will also have indemnity insurance. This gives protection in case something goes wrong.

Solicitors fees when buying a house cash

Data from Unbiased.co.uk found that an average solicitor costs £1,400 when you buy a house in the United Kingdom.

No data shows that solicitors are less expensive when you’re buying in cash.

After all, most of the processes remain the same.

Is there potential for reduced legal rates for cash buyers?

Anecdotally, you may be able to negotiate a better rate with some small, independent firms.

If they charge an hourly fee, then less time may be involved (due to no liaison with a lender being needed).

Also, if you buy at scale, you may be able to negotiate rates based on the volume of work you bring to the solicitor.

But most of the larger firms won’t distinguish in pricing.

We Buy Any Home’s cancellation/withdrawal policies

As a large and experienced cash house-buying company, we have a fair and practical approach to cancellations.

If we need to change our offer—for example, because a defect has been revealed in a property survey—you can withdraw free of charge.

If you simply change your mind, there may be a small charge depending on the resources and time we’ve invested in your property sale up to that point.

However, we handle each situation individually and understand everyone’s circumstances.